Abstract

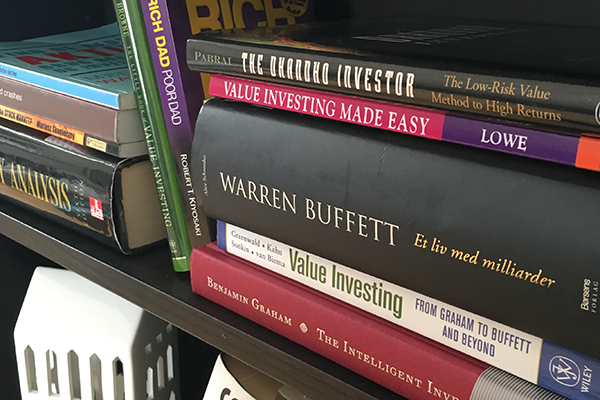

- This blog post is the first of three in a series that attempts to distill the key take-aways from 20 value investing books. The first domain, which is covered in this post, concerns the value investor’s mindset.

- In short, the value investor is a 1) patient and 2) contrarian, and 3) rational individual who 4) thinks like an owner, and in length 5) understands the discrepancies between price and value, hence enabling him/her to take advantage of the bargains that are occasionally offered by Mr. Market.

This blog revolves around my journey into the value investing philosophy. Hopefully, in due time I will possess a Dhandho-mindset and cultivate a methodology that is in alignment herewith, i.e. being able to locate opportunities with a minimal downside while ensuring a large upside potential. My latest book summary marks my ‘20th book-versary’. I will in this posts series consisting of three parts try to outline the recurrent themes from these +8,000 pages. This first part centers on the value investor’s mindset.

Recently, I saw a YouTube video featuring Howard Marks in which he explained that value investing isn’t an algorithm, but a mindset. It’s a recurrent theme in basically all books I’ve read. You may be very clever, but if you don’t possess the proper mindset and a stodgy psyche, it’ll be quite difficult to behave as a value investor. Below I’ve listed the main characteristics, which I have detected from the four handfuls of books I’ve read thus far.

Think like an owner

A vast number of market participants acquire stocks based on The Greater Fool Theory. It dictates that ‘investors’ buy assets, which have already experienced large gains, based on an irrational gut feeling that said asset’s price (not value!) will increase even further, hence allowing the ‘investor’ to sell it to a ‘greater fool’ later on. Rationality, analysis and intrinsic value aren’t given any credit. Rather, the asset is acquired with the intend of dumping it to someone else (quickly!). Needless to say, that’s an untenable ‘strategy’ for achieving consistent, long-term success in the stock market.

That’s why e.g. Warren Buffett regards investments from an owner’s point of view. “Think like an owner” is the ever-repeated maxim of Warren and other value investors. When buying a stock, you’re not just the owner of a certificate, but also the business said piece of paper represents. It means that you have a proportionate claim on the company’s assets and the future income it generates. You entrust the management of said company with your capital; hence, you must have complete faith that the managers act in the shareholders’ interests. This point is alfa-omega for Warren. He is on a constant quest for honest and capable management teams that are able to compound your capital through intelligent capital allocation and investments that widens the business’ moat (cf. part II of this post series).

You can read more about this distinction between the speculator and the investor in the section “The good ol’ days” in my summary of Security Analysis.

Patience is the greatest virtue

In The Little Book of Value Investing, Christopher Browne explains that 80-90% of one’s investment returns occurs 2-7% of the time. Attempting to time the market thus requires extraordinary luck or inconceivable skills; most often, the former would be the dominant force. Hence, you should rather focus on continuously searching for bargains, and let time determine each decision’s faith.

Yet, you shouldn’t be completely indifferent about the market’s ebb and flow. In The Most Important Thing, Howard Marks underscores the importance of paying attention to the ‘pendulum’. When the market seems generally overpriced based on historic averages, the investor should be cautious. For instance, at the moment, the S&P500’s Shiller P/E is +30, indicating a 3% long-term yield (read more about the Shiller P/E in Irrational Exuberance). This level is on the same level as 1929 and above that of 2007. You can thus with some ease conclude that the market is indeed expensive compared to historic levels. However, Howard says you shouldn’t let this frighten you to such a degree that you don’t dare striking on the (yet rare) bargains the market will offer you at times. Personally, I still invest despite a +30 Shiller P/E. But, I’m making sure to stay 50% in cash, so I can place large bets when (hopefully!) the truly extraordinary businesses such as P&G, Coca-Cola and Mastercard will come on sale when the next recession comes around.

Mr. Market – your friend, others’ enemy

Those who have read The Intelligent Investor have acquainted themselves with Benjamin Graham’s manio-depressive persona, Mr. Market. He’s the invisible partner in any business, both the ones you own and the ones you don’t. Each day, Mr. Market knocks at your door with an offer to either buy your share of X or sell his stake to you. Mr. Market has one major weakness, namely his irrational approach to his holdings. Some days, Mr. Market will be shivering with fear and panic, causing him to dump his positions at give-away prices. On other days, envy and greed will blur his judgment, leading to him offering premiums for your stake.

These swings in price make objectivity impossible, hence allowing price and value to deviate from one another. This enables the value investor to spot and take advantage of bargains; stocks selling at a price significantly below its intrinsic – or fair – value (the price, which the security should be traded at as so forth the market was governed exclusively by intelligent buyers and sellers). The key, of course, is to stay rational so you may exploit Mr. Market’s weaknesses.

Use your RQ, not your IQ

In length of the previous section, rationality is key when it comes to achieving consistent, long-term investment success. Kurt Kara emphasizes this in The Rational Investor when explaining that one’s rationality quotient (RQ) is more important than your IQ. It’s all about being able to look prosaically at an array of facts in order to arrive at a rational assessment of a business’ intrinsic value.

This ability is the essence of second-level and System 2 line of thinking, which are dealt with in The Most Important Thing and The Black Swan, respectively. In short, the second-level thought process is all about being able to disregard your emotions, and keep a keen eye on facts and rationale. First-level thinkers go: “This is a great company – I’ll buy the stock!” or “The earnings forecast have been downgraded – I’ll sell immediately!” The second-level thinker would take the step further, and wonder: “Indeed, this is a great business. But, everybody knows it, and as a result it’s overvalued – I’ll pass.” And “Yes, the earnings forecast are impaired. However, everyone’s selling in panic, so it’s now trading below its intrinsic value – I’ll buy!”

Contrarianism: The art of swimming against the current

It’s implied in the previous section that value investing is rooted in contrarianism. Swimming against the current and buying what everyone else considers repelling requires a somewhat strong psyche. In Deep Value, Tobias Carlisle explains that there are three heuristics that hinder us of acting on these counter-intuitive opportunities, hence causing us to miss out on potential profits.

First, we regard something based on whether or not it matches our stereotype of a group of certain things, e.g. stocks. This heuristic goes under the label representativeness. The second heuristic, availability, dictates that we perceive something based on how easy that perception comes to mind. Anchoring is our tendency to stick with our first impression or conviction, even despite the presentation of convincingly, contradictory information.

To thrive as a value investor, one needs to overcome one’s preferences for “the safe bets”; the stocks and companies the media praises and prophesy golden rainbows. To acquire what others refer to as financial trash can be difficult. But that is the very essence of contrarianism; daring to do the opposite of everyone else. You must be willing to buy when others are selling in desperation, and sell when others are euphoric. “Buy when they hate ’em, and sell when they love ’em”, Howard advises us in The Most Important Thing. The wisdom of the crowds is a paradox. That, which seems obvious to everyone, often turns out not to be the truth. It’s obviously not enough to simply do swim against the current; you need to know why you’re doing it. Analysis and a valuation must document why the price is either too optimistic or pessimistic.

Based on 20 investment books, these are the handful of characteristics I believe roughly represent the value investor’s mindset. Mix these with an analytical approach and a healthy skepticism (read Value Investing: From Graham to Buffett and Beyond), and you’re on your way to becoming a whole value investor. Next step is understanding the overall methodology behind spotting bargains. That’s the focus of part II in this posts series.

2 thoughts on “Lessons from 20 value investing books, part I: The mindset”